20% tariffs for Chinese imports (2025)

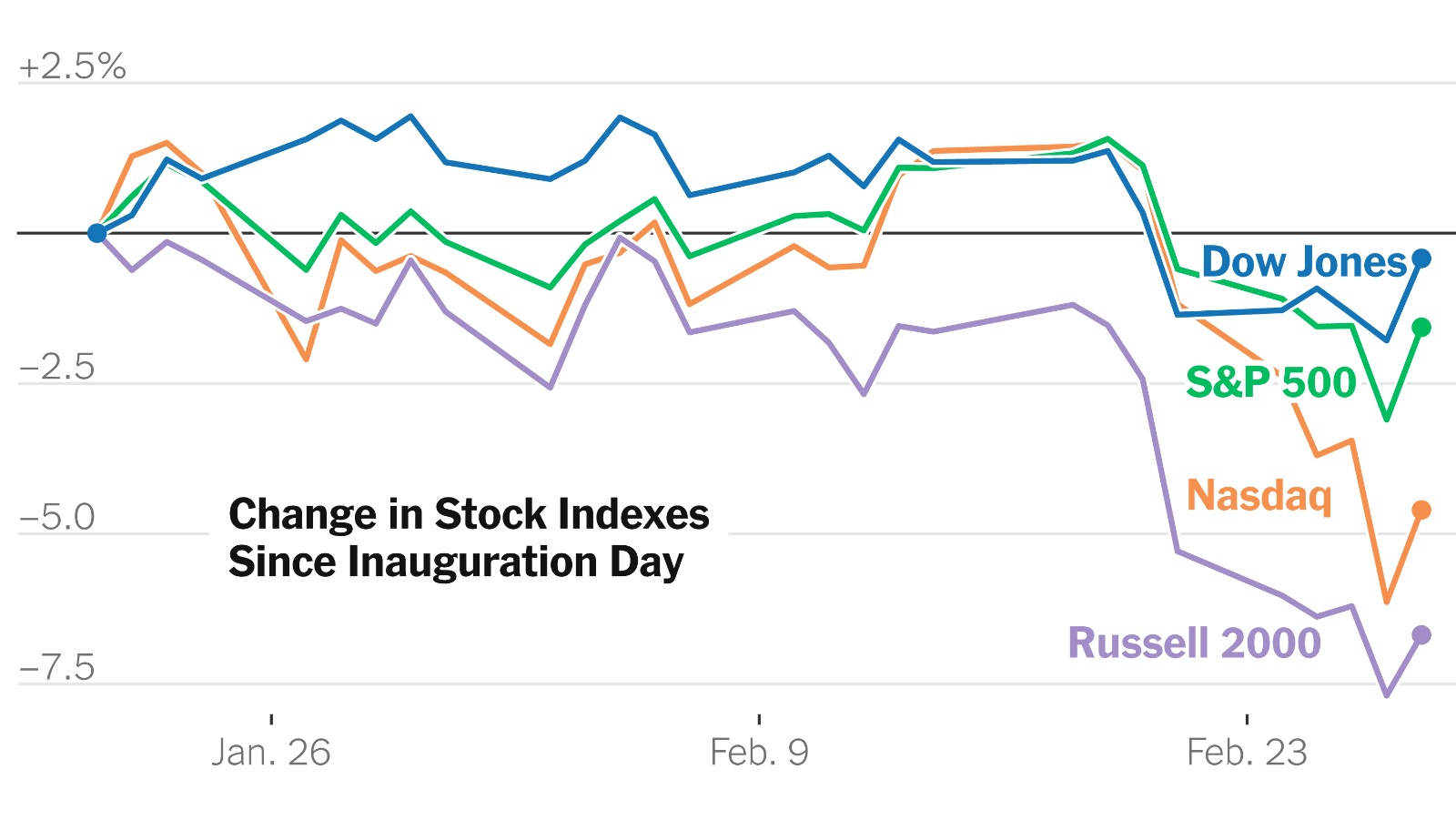

As we enter 2025, the global economic situation will become increasingly uncertain and the Stock market reflects this worrying change. Increased inflation, slower economic growth, updated trade voltages, and particularly the re-establishment of tariffs for China’s imports by former US President Donald Trump, raises concerns across the financial world. Trump’s decision to raise a 20% tariff on Chinese imports has strengthened an already challenging economic situation and the challenges faced by both businesses and consumers. This article examines the Stock market’s response to this pressure, the wider economic impact of increased inflation, and the outcome of Trump’s tariffs on Chinese imports. Many important inventory indices such as the S&P 500 and Nasdaq are slower, even lower, and even volatility. Investors are becoming increasingly cautious, and the former optimistic outlook for economic expansion is alleviated by many factors, including inflationary pressures, global trade stress and rising interest rates. Traditional sectors such as manufacturing, retail and real estate have exposed a significant slowdown.

Previously filled by strong corporate income and economic recovery, the US and global markets have now addressed the convergence of negative factors that have steamed optimism and re-thought their strategy to investors. Growth has fallen, and analysts are currently forecasting a long period of slow, economic expansion, with few strong signs of a strong recovery shortly. This is strengthened by an inflationary environment that undermines purchasing power, slowing down demand for goods and services, and slowing down the pace of business brands. In the US, inflation is at a level that has not been observed for decades, and the costs of everyday goods and services are steadily increasing. Food, energy, and housing costs are particularly stressful for consumers who put budgetary constraints on and contribute to the decline in consumers.

Inflation Issue:

Inflation is an important issue because it not only reduces consumer shopping, but also increases the operating costs of businesses. Companies, particularly in the fields of production, transportation and consumer goods, are exposed to rising raw materials and labor costs, and ultimately pass on to consumers in the form of higher prices. This inflationary pressure creates a vicious cycle. Higher prices affect demand, while companies increase prices to compensate for higher costs, contributing to higher inflation. First, inflation undermines the actual value of future revenue. With an increased cost of capital, companies may find it more expensive to borrow money to expand or invest in new projects. This slows down economic activity and reduces the growth outlook for many companies. Furthermore, inflation leads to higher interest rates. This is because central banks are increasing interest in reducing inflationary pressures.

In 2025, the Federal Reserve aims to continue its aggressive deprivation policy and reduce inflationary pressures. Higher interest rates have a significant impact on the Stock Market as they increase the cost of capital for the company. As mortgages, car loans and credit card debt become more expensive, consumers can reduce the income available to their goods and services. This will affect corporate income, particularly in the consumer industry. A slowdown in spending and business investments contributes to wider economic delays and rejects the Stock Market. Investors tend to change their fairness to bonds that offer more stable returns in an uplifting environment. This shift contributes to the latest underperformance in the stock market as capital continues to flow from stock exchanges and safe and predictable assets.

The Federal Reserve’s Aggressive Debt Policy in 2025 and the Impact on the Stock Market in 2025:

In 2025, the US Federal Reserve killed sustained aggressive monetary policy to curb the economy’s inflation and stabilize. After years of negative inflation, central banks have focused on using higher interest rates to reduce inflationary pressures. This strategy is naturally important for controlling inflation, but has a significant impact on the broader economy, particularly the stock market and consumer behavior. To recover prices and economic value, the Federal Reserve will raise interest rates and reduce curbs in offers and demand affiliation. This strategy is effective in adapting to inflation. This includes higher interest rates on mortgages, car loans, credit cards, and business loans. Total capital costs increase, making it more expensive for businesses to fund new projects, expand their business, and maintain existing activities. As a result, companies can cut investments, slow growth, and lead to lower profitability. The stock market is particularly sensitive to changes in interest rates due to the direct impact of movement and the assessment of corporate interest rates. Car loans and credit card debt will become more expensive, reducing available income and lowering consumer costs. If credit costs rise, households can recover large purchases such as homes and vehicles, reducing discretionary costs such as cooking and entertainment.

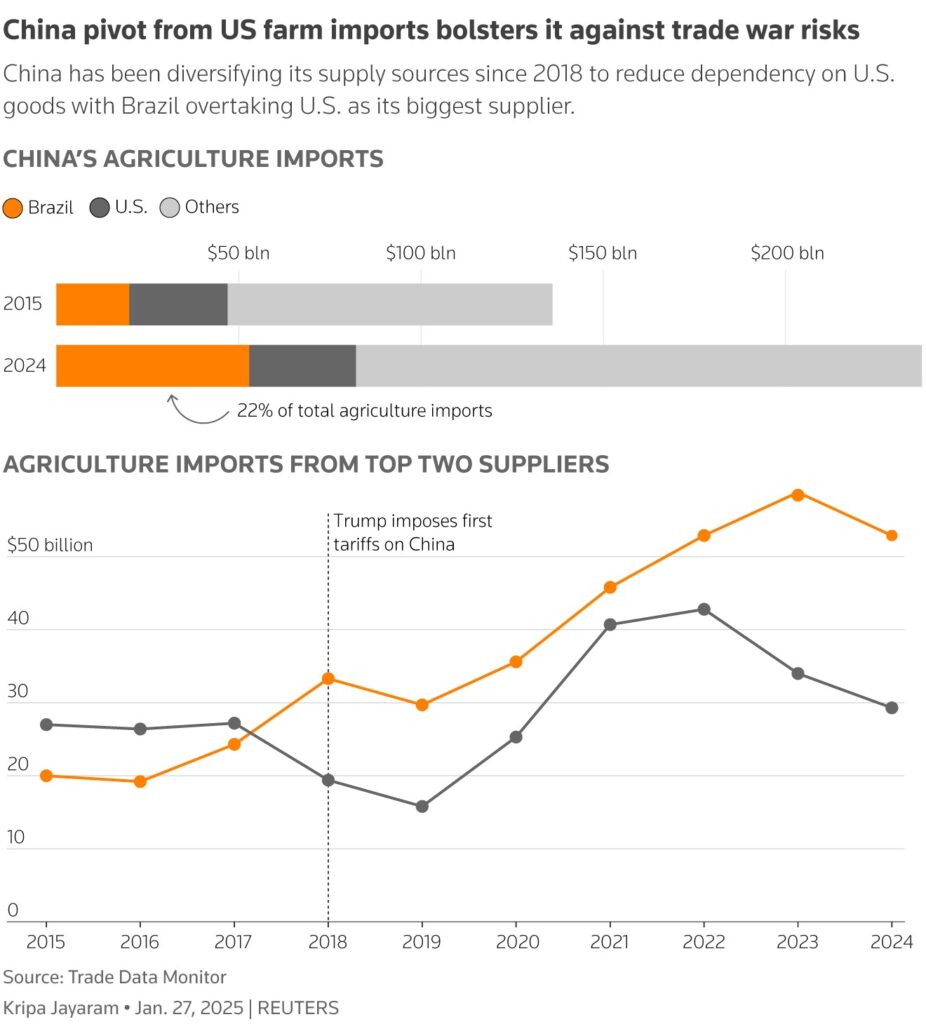

Trump’s restructuring tariffs on Chinese imports: a new trade war

In the middle of these economic challenges, former US president Donald Trump, who is currently fighting for reelection, has re-enacted tariffs on Chinese imports at a rate of 20%. This step has sparked considerable concern among global economists, managing directors, and political decision makers. The decision to impose extremely high tariffs on Chinese people is a continuation of Trump’s protectionist trade policy, which first became prominent during his term of office from 2017 to 2021. China is a leading provider of US goods, and a 20% tariff on Chinese imports increases the costs of many everyday products, electronics, and household items. Many consumer goods, such as smartphones, computers, and household appliances, are manufactured in China and imported into the US. These products are now more expensive for American consumers and are tightening pressure in connection with already exposed inflation. An increase in daily product costs reduces the available revenue for consumers, leading to reduced consumer confidence and costs. Many US manufacturers receive products from China due to low labor costs and developing supply chains in the country. New tariffs could reduce demand by companies having to absorb increased costs and reduce profit margins or transfer higher costs to consumers. China’s retaliation fees for US products are a clear way of doing so and could lead to trade obstacles between the two countries. Companies may be forced to re-think their supply chain strategies. Supply chain strategies can force production to move to other countries or absorb additional tariff costs. Care chains around the world are hampering the COVID-19 pandemic, and many industries are still working to recover from these obstacles. With a 20% tariff on Chinese imports, these endangered species supply chains set additional loads, especially in industries that rely on Chinese products as raw materials or finished products. Companies need to find new suppliers outside of China and incorporate tariff-related costs. Both could reduce production and raise prices. This has contributed to rising prices and lower growth around the world. US companies that rely on or are exposed to China’s imports, such as Apple, Tesla, and General Motors, rely on Chinese factors and production. They are particularly susceptible to customs duties. Former President Donald Trump’s decision to replicate a 20% tariff on Chinese imports is even more complicated. Along with inflationary pressures and interest rate hiking pressures, the policy places the stock market under its burden.

Uncertainty Created By Supply Chain Tariffs:

In this challenging environment, investors need to be vigilant and adaptable. The uncertainty created by supply chain tariffs and global obstacles requires a careful investment approach. Given growing volatility, sectors that are less dependent on international trade, such as healthcare and suppliers, may offer more stability. Additionally, protected investments such as inflation-protected securities (TIP) and raw materials such as gold can be covered against price increases. During this time, navigation, where growth is slow and inflation and trade voltages increase, requires a strategic approach that takes into account the developing economic landscape. As political decisions address these issues, the stock market path remains uncertain and investors must prepare for ongoing volatility and risk.

Navigation of Economic Uncertainty in 2025, increasing inflation and trade voltages, will be effective in a combination of slow growth in the global economy. This challenging landscape shapes the outlook for financial markets, with investors facing increased volatility and uncertainty.

Also Read This: Budget Resolution Passed on Tuesday, Trump “Big Beautiful Bill” Seeking $4.5 Trillion in Tax Breaks

Conclusion:

In summary, the current economic environment with slow growth, increased inflation and escalating trade voltages presents considerable challenges. As political decisions continue to shape the economic landscape, it is clear that a well-thought-out strategic approach is needed for these turbulent era voyages. Diversification, concentration in the defense sector, and consideration of inflation systems are crucial in reducing potential losses. The future is unpredictable, but people who are informed, flexible and focused on long-term goals are in a better position to address the challenges and opportunities in market development.

If progress is made by 2025, the global economy is facing a unique convergence of increased inflation, increased trade voltage and increased growth. This combination of factors creates a sophisticated economic landscape, with increasing volatility and uncertainty affecting financial market outlook. This dynamic continues to affect both consumer behavior and business performance, so investors must prepare for continued fluctuations.

How to move forward requires strategic decisions and adaptability. Diversification, reliable sector concentration, and consideration of inflation systems are crucial for treating risks. The short-term outlook remains uncertain, but those who remain informed and flexible can maintain a long-term perspective, but are better positioned to navigate the complexities of this unstable economic environment. The key to successful navigation of these challenges is the balance of risk and opportunity as the global economy adapts to its developing reality.